*all prices are in AUD unless otherwise stated

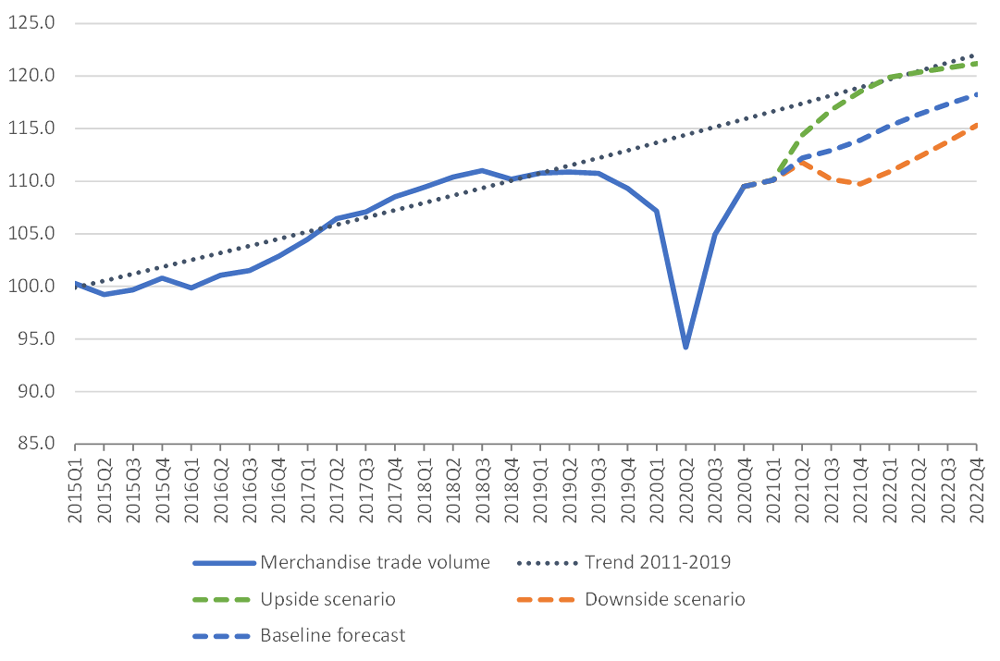

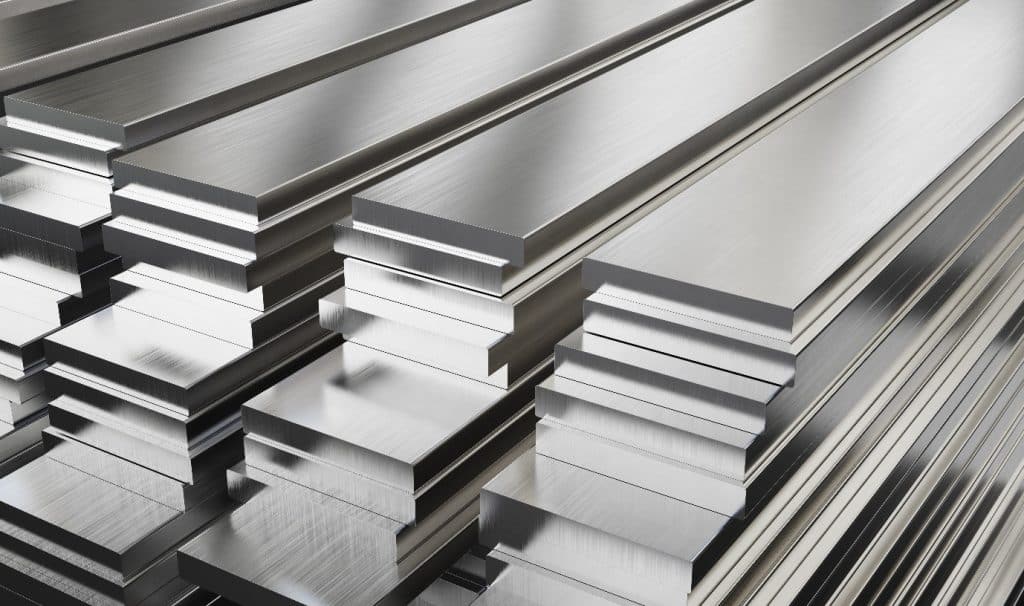

The price of steel has reached unprecedented levels, even managing to eclipse the previous peak recorded in the GFC era of 2008. In the last year to August 2021, the price of hot rolled coil steel has increased by more than $1,090AUD approx. per tonne. In short, HRC has increased by almost 200% in the last 12 months and the increase is continuing.

Obtaining the price of hot rolled coil by the tonne in Australia is no mean feat. There are so many importers with so many different grades, that for the purpose of this blog, we will reference the commodity as a whole as a price guide. The prices in Australia are of course following a similar trend – almost the exact trend.

| Lowest Price | Highest Price | |

|---|---|---|

| Hot Rolled Coil | $615 per tonne 1/7/2020 | $1,850 per tonne 4/7/21 |

What Happened to get a 200% increase on a commodity used every day?

There is no single factor that has caused steel prices to rise to all-time highs. The most relevant ones are listed below with perhaps the protectionist measures China is taking the most relevant.

A shortage of supply and high demand caused by COVID-19

During the first half of 2020, Covid-19 stopped the construction industry, which slowed the mining industry and as a result, global steel consumption fell dramatically. COVID-19 not only affected the demand for steel worldwide, but with lockdowns in key production areas of the world, global production fell dramatically, hence the cheap price of steel in July 2020. From around March 2020 – later in the USA, governments implemented significant restrictions to people’s freedom as an attempt to control the spread of the virus. This in turn forced the biggest steel producing nations to significantly reduce their production. Hundreds of steel producing companies in both China and the USA as well as in Turkey, Brazil, Germany were forced to close at the height of the pandemic and countless companies in this industry went broke due to a massive reduction in demand. As a result of this halt in production, not only did the international price of steel plummet, but global production also fell to historic levels. The lowest point for hot rolled coil was when it was worth $615AUD a tonne in July 2020.

But come the 2nd half of 2020 and those in the know began to invest (maybe your humble author did and maybe he / she didn’t); and the countries that normally sell steel to help their GDP were realising it might be better to stock the steel for their own infrastructure needs rather than sell it.

In the second half of 2020, the demand for steel began to increase gradually, then frantically, but of course there was a very low supply. Needless to say, you can’t just mine Ore in the Pilbara, leave it in the sun for a few days and boom, you have hot rolled coil steel! The supply shortage was caused of course by a lack of the raw materials being where they needed to be – Australian Ore and Coal was in the ground where it was most valuable for the Australian taxpayers, not on ships (ironically usually built from the very Ore they are hauling!) heading for China. Then in the USA and other Western steel producers there were technical difficulties in that the mills had to get their equipment back up and running, their staff back and working, and as pop culture and the Liberal news machine has taught us, in the USA there was no job keeper or job seeker. If the mill you worked at shut down capacity, you were out on your-you-know-what looking for another job. Furthermore, and fair enough to in hindsight, steel producing nations were reluctant to quickly crank their mills up to full capacity for fear of a possible oversupply if the price of steel fell again. At the same time, in the USA, well let’s just say ‘championed’ by the USA, there was a lot of anti-climate change rhetoric that caused an unexpected peak in demand from the automotive sector, not just in Detroit, but in countries such as Japan and South Korea both of whom had newly elected conservative (right wing) leaders. These two unexpected election result in Asia, together with the right-wing rhetoric coming out of the USA caused unpredicted demand in the automotive sector, which led to a decrease supply for the general market.

By election time in the USA in 2020, the shortage of steel became even more pronounced. This resulted in the average company in Australia having to keep up and pay highly accelerated prices, because steel mills worldwide were focused on customers with long-term contracts. This in-turn left little material for the spot market.

It still seems so ironic that the steel we are talking about comes firstly from baron land in outback Australia. We in this sunburnt land, simply don’t have the infrastructure to turn what is mined into steel. If we did, the steel market would be greener, because Ore and Coal would not have to be moved by ship to be transformed into steel, and we in Australia would have a near monopoly on the market at both ends. We pretty much do on Iron Ore, so we could sell a quarter of the Ore we mine to Turkey and China to produce steel, while having close to the world’s supply of steel here to sell. This would double our GDP, after building the mills and other infrastructure, make for a greener industry, because as it stands, the Ore gets mined, then shipped, turned into steel, then shipped again. If we had the organisational structure in place, we would transport the Ore by solar powered train to our mills and smelters, keep the little bit we need for our own infrastructure then sell and ship the rest, thus shipping it once instead of twice.

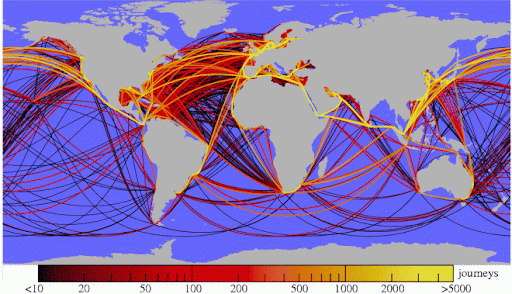

Despite the above optimism, in early 2021, steel buying nations, especially those in Europe were forced to look for alternatives. Unfortunately, the alternatives just led to more problems. They encountered high steel prices, significant transportation costs, port congestion and protectionist trade policies. These aspects were important obstacles for the acquisition of steel from other countries not less Australia.

Today there is still a lack of supply in Australia, with high prices and long delivery times the standard barriers to development. The current situation allows steel producing nations to regularly raise their selling prices, which translates into little room for negotiation in the acquisition of this material. Hence why, we need a government that doesn’t pander to the USA nor China and uses some of the mammoth profits from selling our raw materials to develop the industry needed to turn the Ore to steel right here. How do we get free of a lack of reliable supply and get back to buying steel at a reasonable price? For mine there are three main motives that is keeping the price of steel high.

- Increase in raw material prices

The increase in the price of steel is obviously linked to that of the raw materials it is made up of. Raw materials such as Iron Ore and Coal among others – can you start to see how we as Australians aren’t innocent in all this!

Here are the price fluctuations for two of the main ingredients in steel in the time of Covid-19.

Australian Iron Ore

- Low, May 2020 – $115AUD / metric tonne

- High, May 2021 – $299AUD / metric tonne

Australian Coal

- Low, July 2020 – $71AUD / metric tonne

- High, July 2021 – $256AUD / metric tonne

See how the pattern matches to the above discussed figures?

Australian Iron Ore today 23 November 2021 – $126 / metric tonne

Australian Coal today 23 November 2021 – $326 / metric tonne

Now before all you smarty pants’ out there rush off to sell your Rio Tinto and Glencore shares to buy Bitcoin; consider the following…

Policies to favour domestic supply and export restrictions in some countries have led to and will continue to lead to a decreased flow of steel to Australia. The tendency among some countries with the industrial capacity to over stock to avoid running out and be able to properly serve their own domestic customers has contributed to the shortage of steel and is why Coal and Ore shares will continue to go up in Australia.

2. Protectionist measures

CHINA

The updated policy of the Chinese government is to eliminate the VAT refund of 13% for steel exports. Without being an economist, this means that Chinese iron and steel producing companies will be treated as domestic sellers by not receiving the traditional 13% VAT rate, which acts as a tax break. Now if your humble author remembers their commerce classes from the ‘1990s, this will result in a higher cost for the exporters unless they can dump the 13% cost increase on the foreign buyers, like us in the Land Down Under, which produces an end result of Australian steel importers having NO CHOICE WHATSOEVER but to increase the price of steel. In addition, China is absorbing much of its own production, and that of as many other countries it can get its hands on, to supply its domestic market. A very significant piece of data is that steel exports from China in 2020 fell by 72% while its imports grew by 150%. In other words, China is hording the stock, as its internal demand has exceeded its production. That’s one way to look at it; China is trying to get most of the world’s steel to satisfy its huge infrastructure sector. Or much like the oil crisis of the early ‘1970s, China may well be holding the world to ransom regarding the exportation and the price of steel. If they have got it all, then without steel, the world will struggle to expand and build for the busting populations most major cities are enduring.

Or… and this is just the humble author’s conspiracy mind coming out. Is China doing this to meet their promise of being carbon neutral by 2060? Let’s face it, if all the steel is in one place, countries will be forced to come up with greener living alternatives faster, steel won’t be shipped around the world, countries will be forced to build cars with something else apart from metal – there are a million ways in which hording steel can help the environment. It will force countries to come up with renewable energy features faster. But that doesn’t help China’s goal of Carbon neutrality, which is achieved when the same amount of CO2 is emitted into the atmosphere from which it is removed. Perhaps the Chinese have found a way to construct in a greener way and with near on two billion people to house, a lot of steel will be needed even if they have discovered the best green building techniques ever seen, but it just may be happening. We at Danterr have a product called Equinox which encompasses thermo-dynamic foam and pins to hold the foam in place in concrete walls making insulated walls that equal out the temperature year round in mass housing projects, government facilities such as jails, as well as offices, apartment building and everywhere mass groups of people spend their day and night. Think of them mass saving of coal burning if heaters and air conditioners didn’t need to be used even 20% as much to a population that large. Building still needs steel, but if China could mass produce green cities (which it is doing) and house their population in homes that barely required heating and cooling, then the electricity need would go down, the burning of coal would go down, and the country’s CO2 output would diminish. This is sounding like more than just a conspiracy theory – rather a well-researched concept.

In Australia we have 22 million people which is around 1% the population of China and we can’t even agree on what emissions target to try and achieve while China, the world’s 2nd biggest polluter has thought three steps ahead and is holding its produced steel, thus not shipping it – CO2 reduction tick. Using innovative products like Danterr’s Equinox and hundreds more products we haven’t even imagined in Australia yet, together with their steel to build new green cities; not just an apartment block here and a jail there, but entire cities for millions of people – C02 reduction tick tick. Burning less coal because less heat and cooling needs to be produced because the population, despite it being greater than all of Europe, Russia, Indonesia, Australia, and the USA combined is moving to a more sustainable way of living in places built with carbon neutral products – CO2 reduction tick tick tick. – we may have discovered China’s entire plan to achieve net zero in a blog dedicated to the price of steel! zeb@danterr.com to discuss.

3. Increased transportation costs

Along with supply problems, there has been a significant increase in the price of sea freight in 2022. According to data pooled from three firms that oversea the price of sea fright, the cost of shipping a 12-metre container on one of eight of the main East-West routes has reached $13,300AUD; an increase of 400% in just one year.

Behind the spectacular increase in the value of ocean freight is the so-called ‘container crisis.’ In other words, there is an unusual shortage of available space to transport goods from Asia to the West. There are two 12 footers sitting not 60 yards from where this blog is being written and they have been there for years. This is happening all over the world. The shipping container is the pallet of the 21st century. They are lying around in paddocks and carparks all over the world, not to mention since the year 2000 around 50,000 of them have fallen in the ocean. One of which containing a certain authors cordless head phones…

Enough

Anyway, that’s enough There are numerous factors causing this rising steel price situation and they are of a very diverse nature. Some people are happy about it, and some are enraged. As a result, it appears that the current situation will stay around for a long time to come, but don’t worry about it because there are two things you can do automatically…

1800 262 383

Blog correspondence zeb@danterr,com

To get a quote on our steel products.